Bond Traders Show Early Signs of Doubting Dovish Fed Pivot

Bond traders who just days ago were piling into wagers for more than six interest-rate cuts from the Federal Reserve this year already appear to be having second thoughts.

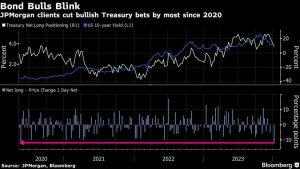

JPMorgan’s latest Treasury client survey showed the biggest net drop in long positions since May 2020, according to a report covering the week through Jan. 2. The shift was driven by both a reduction in longs and new short bets, amid doubts that central bankers would give up their fight against inflation so quickly.

Yet those hoping Wednesday’s Fed meeting minutes would supercharge a recent uptick in yields were left disappointed, with the 10-year falling below 3.9% in the wake of their release, after climbing above 4% earlier in the session. Front-end yields were little changed in choppy trading after the minutes showed officials expected to maintain a restrictive policy stance “for some time” before cutting rates later in the year.

“I don’t think they are in any rush to ease,” Ed Yardeni of Yardeni Research said on Bloomberg TV. “The economy has been doing fine. The unemployment rate is still below 4%. Inflation is coming down but it’s not at 2% yet.”

Cautious sentiment has also appeared in the Treasury futures market, where Tuesday’s price action was consistent with new short positions. In total, a combined $7.6 million per basis point move in risk was added across all tenors except the 5-year notes. Recent flows in options linked to the Secured Overnight Financing Rate have also shown some renewed appetite for hawkish hedges.

Pressure on Treasuries to open the year has been influenced by bigger moves in core European rates — UK 10-year yields climbed over 10 basis points on Tuesday — along with a strong start to US dollar corporate deal flow. Wednesday’s session is expected to see an additional 13 names pricing deals, following almost $30 billion of issuance Tuesday.

Still, rates traders continue to price in roughly 1.5 percentage points of rate cuts, or the equivalent of six 0.25 percentage point moves, by the end of the year.

–With assistance from Michael Mackenzie and Liz Capo McCormick.