Dollar Rally Resilient as Fed Minutes Signal Peak Rates

Dollar Rally Resilient as Fed Minutes Signal Peak Rates. The dollar clung to its turn-of-the-year rally after minutes from the Federal Reserve’s December meeting revealed policymakers agree on holding a restrictive stance “for some time” but expressed a willingness to cut rates in 2024.

The greenback touched session highs against the yen and euro immediately following the Fed release, only to pare the day’s gains as traders digested the updated minutes and longer-dated Treasuries reversed losses. The dollar rallied as much as 1.2% against the Japanese currency to the day’s high of 143.73, while the euro slipped as much as 0.5% against the greenback to a two-week low of $1.0893.

Momentum behind the dollar has been building so far in 2024, with a Bloomberg gauge kicking off the year notching its best one-day performance since March. Apart from Wednesday’s release of the minutes, an array of labor-market data due later this week is forecast to highlight a US labor market that remains resilient while gradually cooling.

“The unwinding of investors’ aggressive Fed rate cut expectations has helped the dollar recover at the start of 2024,” said Valentin Marinov, head of G-10 FX strategy at Credit Agricole CIB. “A lot of negatives are in the price of the currency, and the dollar should therefore remain a buy on dips as we head into data reports.”

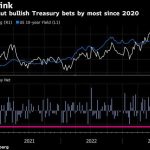

Signals in the market also offer support for the greenback. The Bloomberg Dollar Spot Index’s 14-day relative strength index recently traded below 30, an indication to some that the currency is now oversold and primed for further gains.

Over the past year, there have been only four occasions when that level was hit. The greenback rallied over 4% from early-February to mid-March, and almost 7% from mid-July to early-October, amid expectations for Fed tightening.

The rise from Nov. 29 to Dec. 11 was shallower and shorter-lived, as bets on Fed cuts picked up. Still, the dollar gauge managed to advance 1.4% from trough to peak until its 200-day moving average put a lid on potential gains.

This time around, the Bloomberg dollar gauge still has about 1.0% to go before hitting its 200-day moving average.

(Updates headline, chart, market reaction after release of FOMC minutes).